Your Trusted EstaTe Planning Attorneys

If you are preparing to start your estate planning journey, our Troy, MI estate planning lawyer can help you make the best choices to secure your future. Estate planning involves more than just dividing and distributing your assets. An estate planning lawyer can assist with many different elements of estate planning, all aiming to help protect your future and ensure that it plays out according to your wishes. To discuss your estate planning journey, contact our team at Gudeman & Associates, P.C. today.

Wills And Trusts

Creating and regularly updating a will is a crucial part of ensuring that your assets and wealth are distributed according to your wishes after your death. Beyond leaving instructions for the distribution of assets and property, a will can also name an executor, appoint guardians for minor children, instruct the payment for debts and taxes, aid in the transition of investments, and more.

Trusts offer certain options that wills do not. Depending on the type of trust, a trust may enable you to put conditions on gifts, arrange the care of a beneficiary, and provide important instructions for any final arrangements. While they can provide options that wills do not, they also bring different complications. Our Troy estate planning lawyer can help you determine if a will or a trust is best for your situation and assist you in drafting and updating your will or trust.

Durable Power Of Attorney

A durable power of attorney document appoints an “agent,” often a family or trusted friend, who can act in your place and handle various legal, health, and financial decisions and responsibilities if you are not able to do so. Preparing this document ahead of time makes it easy for your family to make necessary healthcare decisions and any remaining payments if you are incapacitated or after your death.

Family LLCs

A family LLC is a limited liability company that is owned and operated by members of your family, giving you the same benefits as a regular LLC. Our Troy estate planning lawyer can help you set up a family LLC and understand the benefits that it can offer for the distribution of wealth, income, and assets. A family LLC allows your family to protect, invest, and distribute their income to their family members across generations, and can be an important and rewarding component of estate planning.

Seeking Dedicated Representation

Navigating the estate planning process can be daunting when done on your own. From wills and trusts to durable powers of attorney to family LLCs and all other components of estate planning, there are a multitude of important decisions to make, documents to draft, and legal processes to follow. An experienced and knowledgeable estate planning lawyer can help ensure that your wishes are followed, that your estate plan is comprehensive and covers all of your needs, and that all necessary legal guidelines and procedures are followed.

A good estate plan is a security blanket for yourself and your friends and family. We will work hard to assist you in creating an estate plan that represents the best possible future. To discover how we can help you with your estate planning needs, contact Gudeman & Associates, LLC today to schedule a consultation.

Crafting a Comprehensive Estate Plan For Your Children

Our Troy, MI estate planning lawyer understands that one of your most significant priorities as a parent is ensuring the well-being and security of your children. To achieve this, creating a comprehensive estate plan tailored to your family’s needs is paramount. In Michigan, as in other states, estate planning involves various elements, all of which can be structured to protect and provide for your children’s future.

Choosing a Guardian for Your Children

One of the most critical aspects of your estate plan is appointing a guardian for your children. A guardian is an individual or couple entrusted with the care, custody, and upbringing of your children if both parents are unable to fulfill this role. When selecting a guardian, consider factors such as their willingness, ability, values, and relationship with your children.

Creating a Will

A will is a legal document that outlines your wishes regarding the distribution of your assets upon your passing. In your will, you can specify how you want your assets to be managed for the benefit of your children. This can include setting up trusts, designating beneficiaries, and ensuring that your assets are used for their education, housing, and other essential needs.

Establishing Trusts for Your Children’s Future

As your Troy estate planning lawyer knows, trusts are valuable tools in estate planning, particularly when it comes to providing for your children. You can create trusts to safeguard and manage assets on their behalf. Common types of trusts for children include:

- Revocable Living Trusts: These trusts allow for the seamless transfer of assets to your children upon your passing while avoiding probate, a time-consuming and costly legal process.

- Irrevocable Life Insurance Trusts (ILITs): ILITs are designed to hold life insurance policies, ensuring that your children receive the death benefit without taxation issues.

- Education Trusts: These trusts are specifically established to cover the costs of your children’s education, including tuition, books, and other expenses.

- Special Needs Trusts: If you have a child with special needs, a special needs trust can provide for their care and financial support without jeopardizing government benefits.

Designating Beneficiaries and Custodians

In addition to creating trusts, you can designate beneficiaries for your assets, such as retirement accounts and life insurance policies. Custodians can also be named to manage financial accounts and property on behalf of your children until they reach a certain age or milestone.

Planning for Your Incapacity

Estate planning is not only about addressing what happens after your passing; it also involves planning for incapacity. You can designate a durable power of attorney to make financial decisions on your behalf and appoint a healthcare proxy to make medical decisions if you are unable to do so. Ensuring these arrangements are in place can provide peace of mind that your children’s needs will be met even if you are incapacitated.

Getting Help With Your Estate Plan

If you are ready to create or update your estate plan to ensure the welfare and security of your children, we invite you to contact Gudeman & Associates, P.C. Our experienced estate planning attorneys are here to listen to your unique needs and guide you through the process. Your children’s future deserves the utmost care and attention; let us help you provide for them in the best possible way. Reach out to our Troy estate planning lawyer now.

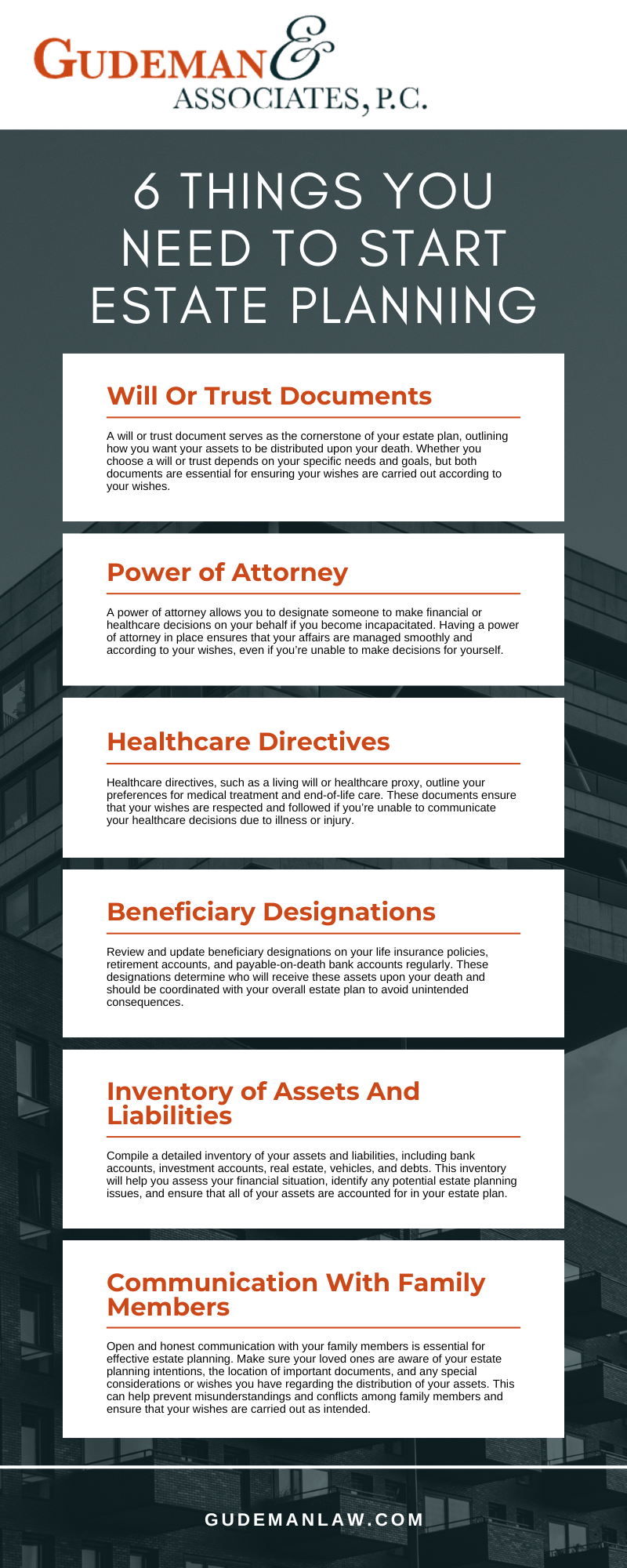

6 Things You Need To Start Estate Planning

Estate planning is a crucial process that allows you to protect your assets, provide for your loved ones, and ensure your wishes are carried out after you’re gone. Everyone will have different needs, but working with a Troy, MI estate planning lawyer will help you create your unique plan. However, there are normally a few common elements for everyone:

1. Will Or Trust Documents

A will or trust document serves as the cornerstone of your estate plan, outlining how you want your assets to be distributed upon your death. Whether you choose a will or trust depends on your specific needs and goals, but both documents are essential for ensuring your wishes are carried out according to your wishes. Consult with a Troy estate planning lawyer to determine which option is best for you.

2. Power of Attorney

A power of attorney allows you to designate someone to make financial or healthcare decisions on your behalf if you become incapacitated. Having a power of attorney in place ensures that your affairs are managed smoothly and according to your wishes, even if you’re unable to make decisions for yourself.

3. Healthcare Directives

Healthcare directives, such as a living will or healthcare proxy, outline your preferences for medical treatment and end-of-life care. These documents ensure that your wishes are respected and followed if you’re unable to communicate your healthcare decisions due to illness or injury.

4. Beneficiary Designations

Review and update beneficiary designations on your life insurance policies, retirement accounts, and payable-on-death bank accounts regularly. These designations determine who will receive these assets upon your death and should be coordinated with your overall estate plan to avoid unintended consequences. It is a good idea to alert your beneficiaries so they know they are part of your estate planning.

5. Inventory of Assets And Liabilities

Compile a detailed inventory of your assets and liabilities, including bank accounts, investment accounts, real estate, vehicles, and debts. This inventory will help you assess your financial situation, identify any potential estate planning issues, and ensure that all of your assets are accounted for in your estate plan.

6. Communication With Family Members

Open and honest communication with your family members is essential for effective estate planning. Make sure your loved ones are aware of your estate planning intentions, the location of important documents, and any special considerations or wishes you have regarding the distribution of your assets. This can help prevent misunderstandings and conflicts among family members and ensure that your wishes are carried out as intended. Also alert the person who you have named executor of your documents so they know they will be in charge after your passing.

Troy Estate Planning Infographic

Troy Estate Planning FAQs

Here, we address some of the most frequently asked questions about estate planning, a service where a Troy, MI estate planning lawyer can provide invaluable assistance. At Gudeman & Associates, P.C., we understand that estate planning is a vital part of securing your future and that of your loved ones. With this in mind, our team is dedicated to guiding you through the process with compassion and professionalism.

What are the tax implications of estate planning?

Tax implications are a critical aspect of estate planning. Various elements of an estate plan, such as wills, trusts, and gifts, have different tax consequences. For instance, large estates may be subject to estate taxes at both federal and state levels. A lawyer can offer strategies to minimize these taxes, ensuring more of your assets are passed on to your beneficiaries. From establishing charitable trusts to navigating gift tax laws, we tailor our advice to your unique financial situation.

How can a lawyer in Troy assist with guardianship issues?

Guardianship is an important consideration, especially for parents with minor children or individuals responsible for adult dependents. We help you designate a guardian in your estate plan, ensuring your dependents are cared for by someone you trust in the event of your incapacity or death. This process involves discussing your preferences, understanding the legal requirements, and drafting the necessary documents to solidify your choices.

What documents are essential for estate planning?

The cornerstone documents in estate planning include a will, durable power of attorney, and advance healthcare directive. A will dictates how your assets should be distributed upon your death, while a durable power of attorney appoints someone to manage your financial affairs if you’re unable to do so. An advance healthcare directive, or living will, outlines your wishes for medical care if you become incapacitated. As your Troy estate planning lawyer, we ensure these documents reflect your current life situation, wishes, and legal requirements.

How can a lawyer help with charitable giving strategies?

Charitable giving can be an enriching part of your estate plan. We assist in structuring charitable gifts in a way that maximizes the impact on your chosen cause while providing tax benefits. Whether it’s through setting up charitable trusts, donor-advised funds, or making direct bequests in your will, a lawyer can craft a plan that aligns with your philanthropic goals and financial objectives.

What role does a lawyer play in managing estate disputes?

In the unfortunate event of a dispute arising over your estate, an estate lawyer serves as a mediator and legal advisor. We work to uphold the terms of your estate plan while aiming to resolve conflicts amicably. Whether it’s a contested will or disagreements among beneficiaries, our expertise in estate law helps navigate these disputes with sensitivity and legal acumen.

Planning for the future is a profound responsibility, and at Gudeman & Associates, P.C., we’re here to help you every step of the way. With our comprehensive knowledge and personalized approach, a Troy estate planning lawyer from our team can turn the complex task of estate planning into a clear and manageable process. If you have any questions or need guidance in estate planning, don’t hesitate to reach out to us. Let’s work together to secure your legacy and provide peace of mind for you and your loved ones.

Get Started Today

At Gudeman & Associates, P.C., we understand that estate planning can be a complex and emotional process, but we’re here to help. Our experienced Troy estate planning lawyers can provide you with personalized legal guidance and support throughout the estate planning process, ensuring that your wishes are carried out and your loved ones are protected. Contact us today to schedule a consultation and take the first step toward peace of mind and security for the future.