Understanding the Process of Filing for Bankruptcy

If you are considering filing for bankruptcy and are seeking legal aid and advice, our Southfield, MI bankruptcy lawyer can help you. We understand the gravity of the decision to file for bankruptcy and the importance of fully understanding your options and their implications when doing so. Our team will consult with you on your situation, advise you on the best steps to take and which type of bankruptcy to file for, and assist you with the filing process.

Filing for bankruptcy can be a daunting process, but with the right legal assistance, it can be a crucial step towards a more free financial future. To discuss your case and discover how we can help you, contact our team at Gudeman & Associates, P.C. today.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy, also known as “liquidation bankruptcy” or “straight bankruptcy,” is a form of bankruptcy for people who cannot pay their debt to their creditors. This may include credit card debt, medical debt, and more. Chapter 7 bankruptcy is designed to eliminate debts quickly, often in three to four months. To be eligible for Chapter 7, you must pass a means test. Typically, people will annualize monthly income that is less than that of the median household income for a household their size will qualify. Chapter 7 bankruptcy does not include a payment plan, and it can be a good option for you if you qualify and are looking to prevent a foreclosure on your home or repossession of your car. Our Southfield bankruptcy lawyer will consult with you and determine if you are eligible for Chapter 7 and if it is the right choice for you.

Chapter 11 Bankruptcy

Chapter 11 bankruptcy is also known as “reorganization” bankruptcy. Chapter 11 is available to both business and individuals, but it is often used by businesses to restructure their debts and assets. Chapter 11 bankruptcy allows a business to continue operating under the supervision of a court during the restructuring period. A temporary stay is put in place to halt all collections and foreclosures while a reorganization plan is drafted by our bankruptcy lawyer and then reviewed by creditors. Once approved, the reorganization plan allows you to pay back your debts on more favorable terms for your business and allows you to remain in operation.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy is also a “reorganization” bankruptcy. It involves repaying debts through a payment plan that can span a period of three to five years. Chapter 13 bankruptcy is for debtors that have a stable enough income to repay their debts through the terms of the payment plan. If you can meet the terms of a repayment plan, this may be the right option for you to repay your debts while protecting your assets. Our Southfield bankruptcy lawyer will help you work towards a repayment plan that is feasible and as favorable as possible for you.

The Benefit of Legal Representation

When considering a process as sensitive as filing for bankruptcy, making an informed decision is paramount. A bankruptcy lawyer can help you identify the right type of bankruptcy for you, assist you with drafting documents and filing, and represent you and your interests every step of the way. Whether it is coming up with a reorganization plan for your business or a payment plan for your debts, we can help you ensure that you are working towards a brighter financial future. To discuss your case, contact Gudeman & Associates, P.C. today to schedule a consultation.

Why You Should Consider Filing For Bankruptcy

Facing overwhelming debt can be a stressful and overwhelming experience, but bankruptcy can provide a path to financial relief and a fresh start. At Gudeman & Associates, P.C., we understand the challenges you may be facing, and our Southfield, MI bankruptcy lawyer is here to help you explore your options and make informed decisions about your financial future.

Understanding Bankruptcy

Bankruptcy is a legal process designed to help individuals and businesses struggling with debt eliminate or restructure their debts and obtain a fresh financial start. There are different types of bankruptcy, including Chapter 7, Chapter 13, and Chapter 11, each with its own eligibility requirements and benefits.

One of the primary reasons to consider filing for bankruptcy is to obtain debt relief. Bankruptcy can eliminate many types of unsecured debts, such as credit card debt, medical bills, personal loans, and utility bills, allowing you to regain control of your finances and move forward without the burden of overwhelming debt. If you have a lot of debt, then you most likely hear from creditors a lot trying to collect payments.

Filing for bankruptcy triggers an automatic stay, which halts all collection activities by creditors, including harassing phone calls, letters, lawsuits, wage garnishments, and bank levies. This can provide immediate relief from creditor harassment and give you the breathing room you need to assess your financial situation and explore your options.

Protect Your Assets

Contrary to popular belief, bankruptcy does not necessarily mean losing all of your assets. Depending on the type of bankruptcy you file, you may be able to retain certain exempt assets, such as your home, car, retirement accounts, and personal belongings. Additionally, bankruptcy exemptions can help protect your assets from being seized by creditors to satisfy your debts. A Southfield bankruptcy lawyer can take a closer look at your case to determine what the best plan for you will be.

While bankruptcy will initially have a negative impact on your credit score, it can also provide an opportunity to rebuild your credit over time. By responsibly managing your finances and debt after bankruptcy, you can demonstrate to creditors that you are a reliable borrower and improve your creditworthiness; bankruptcy does not hurt your credit forever and you can get it back over time. This is a fact that most people are not aware of, and they worry their credit will always be bad; the good news is that your credit will be bad only for a few years and you can do lots of things to rebuild it in the meantime.

Perhaps most importantly, filing for bankruptcy can provide you with peace of mind and relief from the stress and anxiety caused by overwhelming debt. Knowing that you have taken steps to address your financial difficulties and work towards a fresh start can bring a sense of relief and empowerment.

If you’re struggling with overwhelming debt and considering bankruptcy, we’re here to help. Our experienced Southfield bankruptcy lawyer can evaluate your financial situation, explain your options, and guide you through the bankruptcy process with compassion and understanding. Contact Gudeman & Associates, P.C. today to schedule a consultation and take the first step towards a brighter financial future.

The Role of a Lawyer In Protecting Your Assets In Bankruptcy

A Southfield, MI bankruptcy lawyer plays a pivotal role in ensuring that your assets are shielded to the greatest extent possible during the bankruptcy process. When facing financial distress, one of the biggest concerns you might have is the protection of your assets. This is where the role of a bankruptcy lawyer becomes crucial. At Gudeman & Associates, P.C., we understand the importance of safeguarding what you’ve worked hard for. Here’s how:

- Understanding Asset Exemptions: Bankruptcy laws provide for certain exemptions that allow you to keep various types of property. A lawyer that specializes in bankruptcy has in-depth knowledge of both federal and Michigan exemption laws. We can help you understand which assets you can keep, such as a portion of the equity in your home, your vehicle up to a certain value, personal belongings, retirement accounts, and more.

- Choosing the Right Type of Bankruptcy: There are different types of bankruptcies, primarily Chapter 7 and Chapter 13. Each has its way of handling assets. A Chapter 7 bankruptcy may lead to the liquidation of non-exempt assets, while Chapter 13 focuses on reorganization and repayment plans. As your lawyer, we’ll guide you in choosing the bankruptcy type that’s best suited to protect your assets given your unique financial situation.

- Accurate and Strategic Filing: How you file for bankruptcy can significantly impact your asset protection. Incorrectly filed paperwork or missed deadlines can jeopardize your assets. With a professional from Gudeman & Associates, P.C., you can rest assured that your bankruptcy filing will be accurate, strategic, and timely, minimizing risks to your assets.

- Avoiding Preferential Transfers: In bankruptcy, not all asset transfers before filing are viewed favorably. In some cases, the court may view them as preferential and attempt to reverse them. A Southfield bankruptcy lawyer can advise you on what constitutes a preferential transfer and help you avoid actions that might be detrimental to your asset protection strategy.

- Representing You in Proceedings: A lawyer represents you in all proceedings, including meetings with creditors or the bankruptcy trustee. During these meetings, we advocate on your behalf to protect your assets, negotiate terms, and handle any disputes that may arise, ensuring your rights are always at the forefront.

- Post-Bankruptcy Planning: Protecting your assets isn’t just about what happens during bankruptcy; it’s also about planning for the future. We offer guidance on rebuilding your financial health post-bankruptcy, helping you make decisions that safeguard your assets in the long term.

Bankruptcy can be a challenging journey, but you don’t have to walk it alone. At Gudeman & Associates, P.C., our team is committed to providing you with the legal guidance and support you need. We’re here not just as your Southfield bankruptcy lawyer but as a partner in protecting your assets and securing a better financial future. If you’re considering bankruptcy or have questions about how it might affect your assets, reach out to us. Let’s work together to find the best path forward for you.

Southfield Bankruptcy Infographic

Southfield Bankruptcy Statistics

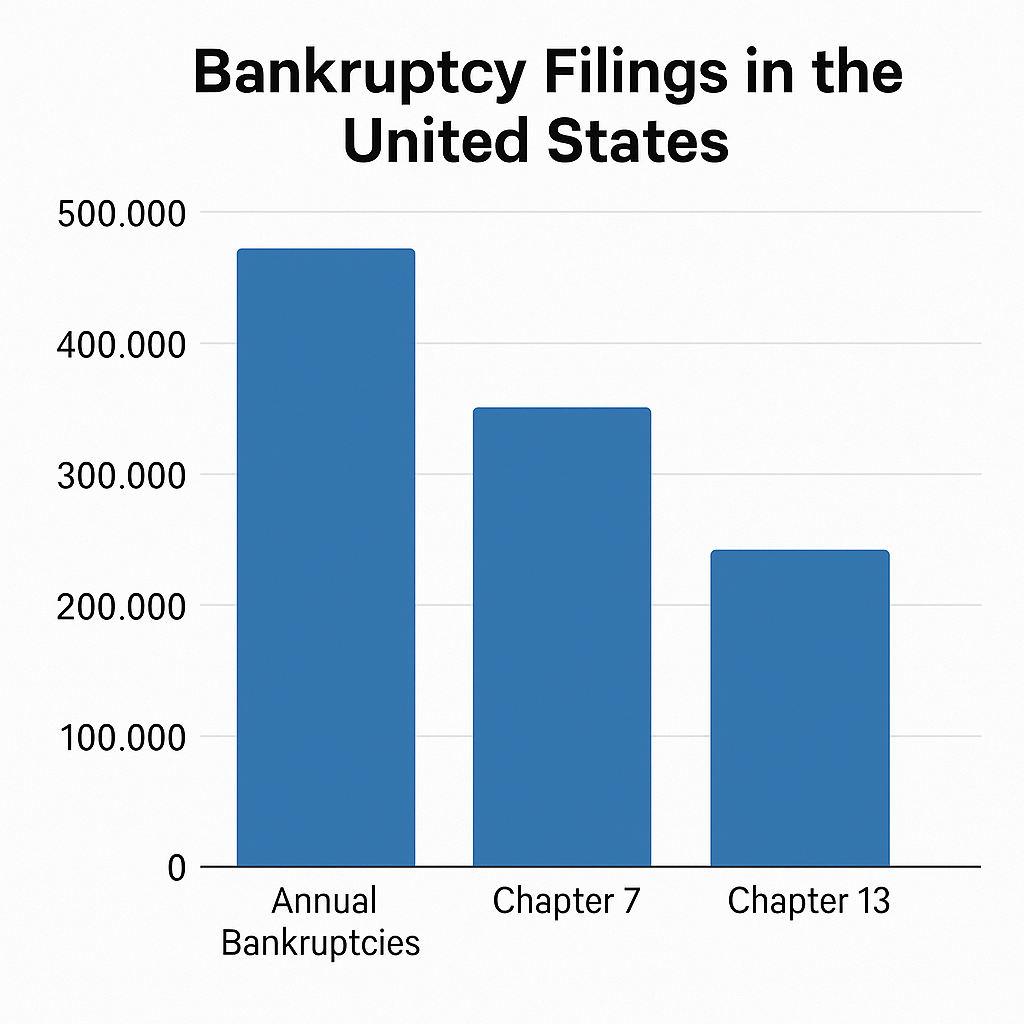

Bankruptcy filings in the United States provide important insight into the financial health of individuals and businesses. According to the American Bankruptcy Institute (ABI), more than 500,000 bankruptcy cases are filed annually, encompassing both personal and business filings. Among personal bankruptcies, Chapter 7 filings—which involve the liquidation of assets to repay creditors—constitute the majority, while Chapter 13 filings—structured repayment plans allowing individuals to retain certain assets—account for a significant portion.

Economic hardship, medical expenses, job loss, and high levels of consumer debt are the primary drivers of bankruptcy. Studies indicate that medical debt is a factor in over 60% of personal bankruptcy cases, highlighting the connection between healthcare costs and financial instability. Business bankruptcies, though fewer in number, can have wide-reaching consequences, affecting employees, suppliers, and local communities.

Demographically, younger and middle-aged adults are more likely to file due to credit card debt or medical bills. In comparison, older adults often face bankruptcy from unexpected expenses or insufficient retirement savings. Geographic variations also exist, with higher filing rates in areas experiencing elevated unemployment or living costs.

Southfield Bankruptcy FAQs

Bankruptcy can be challenging, but your Southfield, MI bankruptcy lawyer can help you find a way forward. At Gudeman & Associates, P.C., we aim to demystify the process and provide the information you need to make an informed decision. Here are answers to some common questions about filing for bankruptcy.

How Can I Determine If Filing For Bankruptcy Is The Right Choice For Me?

Bankruptcy may be a viable option if you find yourself unable to meet your financial obligations, facing foreclosure on your home, dealing with wage garnishment, or using loans to pay bills. Your Southfield bankruptcy attorney can provide a comprehensive review of your financial landscape and help determine if bankruptcy will offer the relief you need and protect valuable assets.

What Are The Differences Between Chapter 7 And Chapter 13 Bankruptcies?

Chapter 7 and Chapter 13 bankruptcies serve different financial situations and offer distinct benefits. Chapter 7 bankruptcy, often referred to as liquidation bankruptcy, allows you to discharge most of your unsecured debts quickly, typically within months, possibly involving the liquidation of some assets to pay off creditors. It’s suitable for those with limited disposable income.

Conversely, Chapter 13 bankruptcy is more of a reorganization, where you keep your assets and pay back debts over a three to five-year plan based on a court-approved repayment plan. This type is well-suited for individuals with regular income who can handle a structured payment plan and wish to avoid foreclosure or repossession of assets.

What Types Of Debt Can Be Discharged Through Bankruptcy?

Most unsecured debts, such as credit card debt, medical bills, and personal loans, can be discharged through both Chapter 7 and Chapter 13 bankruptcy. However, certain types of debts are not dischargeable, including student loans (except in very rare cases), alimony and child support obligations, certain taxes, debts for personal injury caused by driving under the influence of alcohol or drugs, and fines or penalties owed to government agencies.

How Does Filing For Bankruptcy Affect My Credit Score?

Filing for bankruptcy does initially have a negative impact on your credit score. You may see a substantial decrease, and obtaining new credit could be more challenging for a few years. However, bankruptcy also provides a foundation to rebuild your financial stability. With disciplined financial behavior, many find that their credit score can improve faster than if they had continued to struggle with insurmountable debt.

How Long Does A Bankruptcy Stay On My Credit Report?

A Chapter 7 bankruptcy remains on your credit report for 10 years from the date of filing, whereas a Chapter 13 bankruptcy is typically removed after 7 years. Although the notation of a bankruptcy stays on your report for years, its impact diminishes over time, especially if you engage in positive credit activities post-bankruptcy like paying bills on time, maintaining low balances on credit cards, and avoiding new debt.

Southfield Bankruptcy Glossary

If you are seeking guidance on bankruptcy, our Southfield, MI bankruptcy lawyer at Gudeman & Associates, P.C. is here to provide experienced and compassionate assistance. With over 100 years of combined legal experience, our team is dedicated to helping individuals, families, and businesses in Southeast Michigan regain financial stability. Below, we’ve outlined five essential legal terms and concepts you may encounter when discussing bankruptcy.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy, often referred to as “liquidation bankruptcy,” is designed for individuals and businesses unable to repay unsecured debts such as credit card balances, medical bills, or personal loans. Under this process, non-exempt assets may be sold to satisfy debts, but exemptions often protect essential property like homes, vehicles, and personal items. This type of bankruptcy is typically completed within three to four months, providing a fresh financial start for those who qualify through a means test. At Gudeman & Associates, P.C., we evaluate your eligibility and help you take the right steps to protect your assets while resolving your financial challenges.

Automatic Stay

Filing for bankruptcy triggers an automatic stay, an immediate legal protection halting all debt collection activities. This includes phone calls from creditors, wage garnishments, foreclosure proceedings, and lawsuits. The automatic stay offers relief and time to reassess your financial options without pressure from creditors. This powerful tool can provide significant emotional and financial relief, making it one of the most critical aspects of bankruptcy law. Our attorneys use this provision to shield you from creditor harassment while guiding you toward long-term solutions.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy, also known as “reorganization bankruptcy,” is tailored for individuals with regular income who wish to repay debts through a structured payment plan. This plan spans three to five years, allowing debtors to retain their assets while catching up on overdue payments, such as mortgage or car loans. Unlike Chapter 7, Chapter 13 does not involve asset liquidation. Our attorneys work closely with you to develop a feasible repayment plan that aligns with your income and financial goals, ensuring you maintain control over your property while reducing debt.

Bankruptcy Exemptions

Bankruptcy exemptions are legal protections that allow you to keep specific property during bankruptcy proceedings. These exemptions vary by state, and in Michigan, they cover items such as equity in your home, personal vehicles, retirement accounts, and essential household goods. Choosing the right set of exemptions—state or federal—can have a profound impact on the outcome of your case. At Gudeman & Associates, P.C., we use our knowledge of Michigan and federal exemption laws to help safeguard your most valued assets.

Preferential Transfers

In bankruptcy, a preferential transfer refers to payments or asset transfers made to creditors shortly before filing, which could unfairly favor one creditor over others. Courts may reverse these transactions to distribute assets equitably among all creditors. Examples include repaying a large personal loan to a family member or transferring property to a relative. Our attorneys guide you on avoiding such transfers to protect your case and ensure a smooth process through the courts.

Let Gudeman & Associates, P.C. Guide You Through Your Financial Reboot

At Gudeman & Associates, P.C., we’ve helped thousands of clients throughout southeastern Michigan – and now it’s our turn to help you. Get in touch with our team today, and see what a Southfield bankruptcy lawyer from our office can do for you.